Fed rate hike

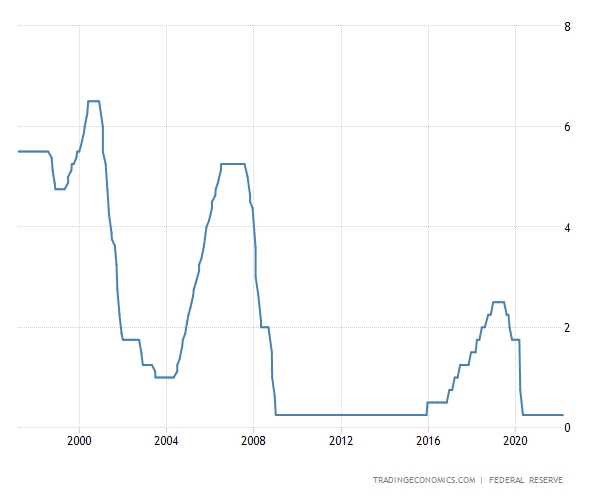

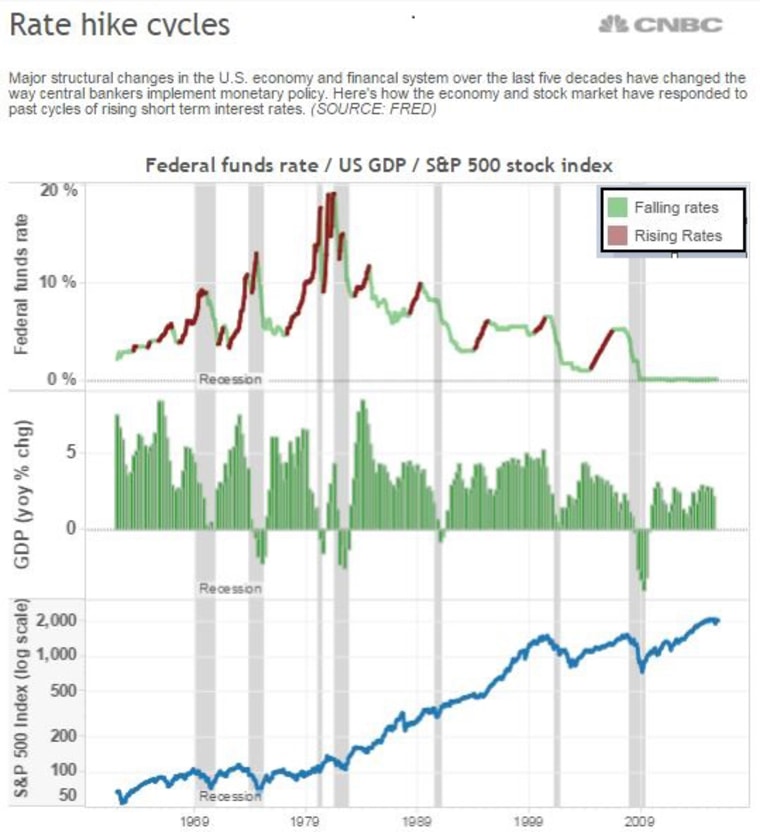

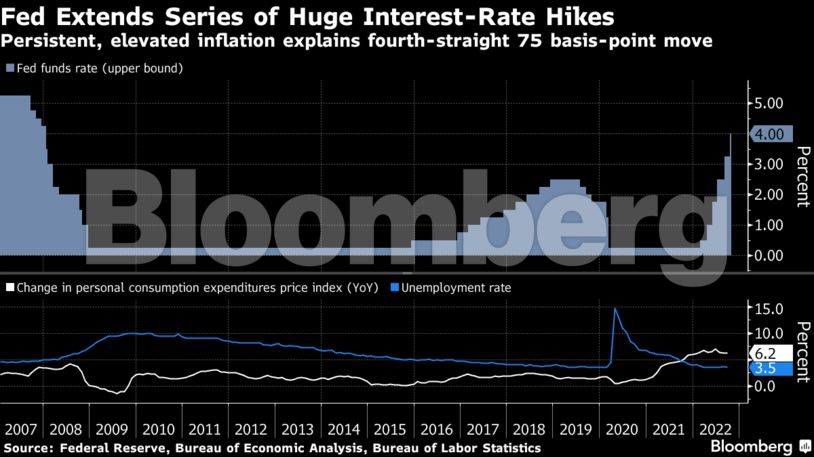

Fed officials have now imposed the sharpest increases in interest rates since the 1980s as the cost of living crisis batters consumers The Federal Reserve stepped up its fight. The median forecast also showed that central bank officials expect to hike rates to 44 by the end of 2022.

Us Fed Hikes Interest Rate By 75 Bps Biggest Since 1994 Highlights Mint

Recession risks are growing but the Federal Reserve is sticking with aggressive interest rate increases for now.

. Published Wed Nov 2 2022 200 PM EDT Updated 25 Min Ago. The Feds five hikes so far in 2022 have increased rates by a combined 3 percentage points or 300 in interest added on every 10000 in debt. Powell announced another interest rate hike on Wednesday.

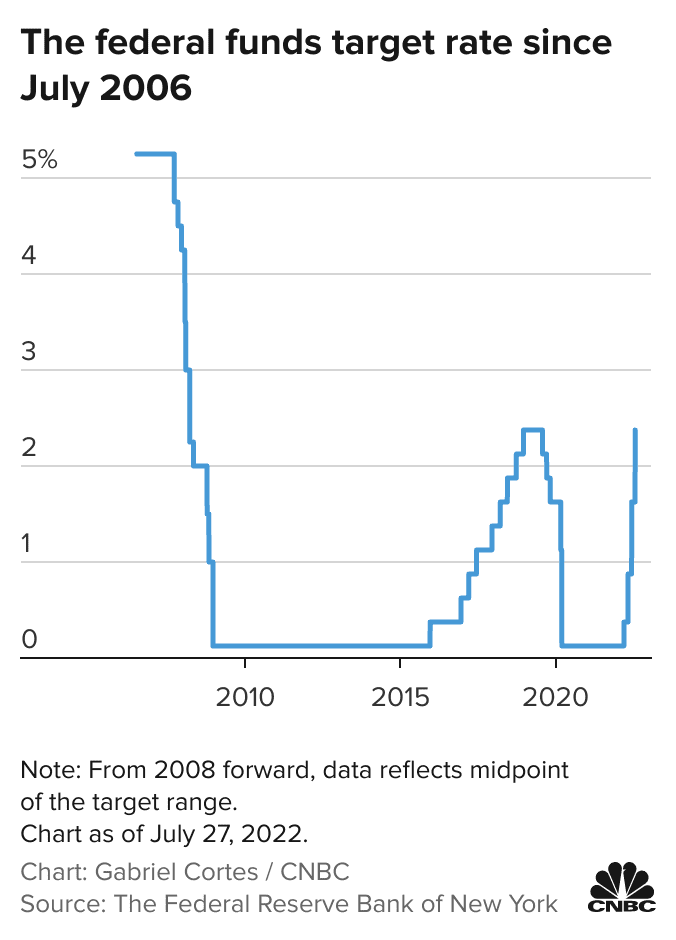

The latest increase moved the. The Feds actions will increase the rate that banks charge each other for overnight borrowing to a range of between 225 to 250 the highest since December 2018. The tight monetary policy from the Fed has already included three outsized 75 basis point rate hikes a 50 basis point rate hike and a 25 basis point rate hike all in a bid to tame.

What does the fed rate hike mean. That implies a quarter-point rate rise next year but. Central bank has raised rates at its last six.

No painless way to bring down inflation. The rate hike the Fed is expected to deliver on Wednesday will move the target federal funds rate 75 basis points higher to a level between 375 and 400. That means the 075 percentage-point hike on Wednesday will add an extra 75 of interest for every 10000 in debt.

The policy decision set the target federal funds rate in a range between 375 and 400 the highest since early 2008. With only two policy meetings left in the calendar year chances are. The latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008.

Fed poised to hike rates by 075 percentage points for fourth time. Fed approves 075-point hike to take rates to highest since 2008 and hints at change in policy ahead. Traders are pricing in a more than 95 chance of another 75 basis point hike at the conclusion of the Feds two-day meeting Nov.

2 according to the CME Groups FedWatch tool. During his post-meeting conference Fed Chair Jerome Powell signaled. The Federal Reserve on Wednesday enacted its second consecutive 075 percentage point interest rate increase taking its benchmark rate to a range of 225-25.

So far the Feds five hikes in 2022 have increased rates by a. Rate hikes are associated with the peak of the economic cycle and. Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

Pricing of futures tied to the Feds policy rate implied a 92 chance that the Fed will raise its policy rate now at 3-325 to a 375-4 range when it meets Nov. Forecasts show another large hike likely by end of year. A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate.

The Federal Reserve ordered another big boost in interest rates on Wednesday and warned that rates will have to. Wednesdays rate increase - the fifth in a row - lifts the rate the Fed charges banks to borrow from near zero at the start of the year to 3 for the first time since early 2008. The rate-making Federal Open Market Committee hiked the benchmark interest rate by 075 percentage points at the end of a two-day meeting.

Potential Fed interest rate hike. For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates. Fed lifts target interest rate to 300-325 range.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IT4N4ITWX5P2VPYL2FZW63IQYE.png)

Analysis Hot Inflation Fuels Case For Big Bang Fed Rate Hike In March Reuters

Fed Decision July 2022 Fed Hikes Interest Rates By 0 75 Percentage Point

What To Expect When The Fed Raises Interest Rates Youtube

How The Fed S September Interest Rate Hike Will Affect You Money

Fed Hikes Interest Rates By Three Quarters Of A Percentage Point In Boldest Move Since 1994 Cnn Business

About Those Fed Rate Hikes They Might Take Longer Than You Think Chief Investment Officer

A History Of Fed Leaders And Interest Rates The New York Times

Fed Raises Interest Rate By 25 Basis Points In First Rate Hike Since 2018

What History Tells Us About This Week S Fed Interest Rate Hike

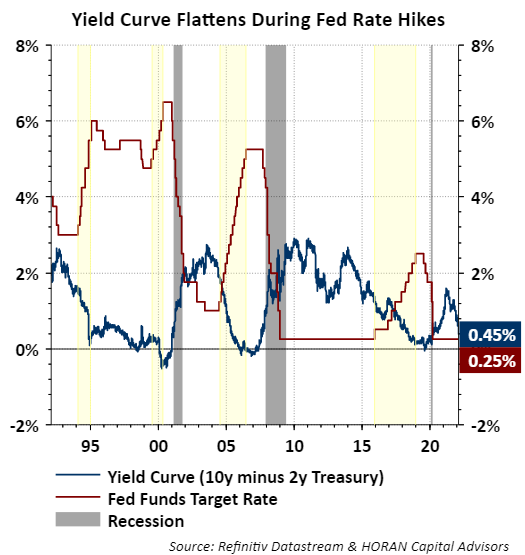

Fed Rate Hikes And Recessions Horan

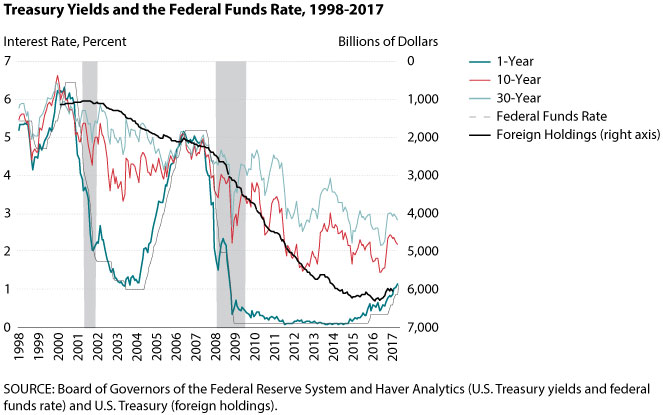

The Rising Federal Funds Rate In The Current Low Long Term Interest Rate Environment St Louis Fed

Interest Rates Vs Inflation Country By Country Approach World Economic Forum

Doshi Associates Cpa Pllc Interest Rate Hike

What Would A Fed Interest Rate Hike Mean For Markets Knowledge At Wharton

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YYKCOV7NSVD4PFSE3YUX342WJI.png)